Product Description

Customers build a profile with the regular health and lifestyle info

for underwriting plus a schedule of goals and needs for each family member.

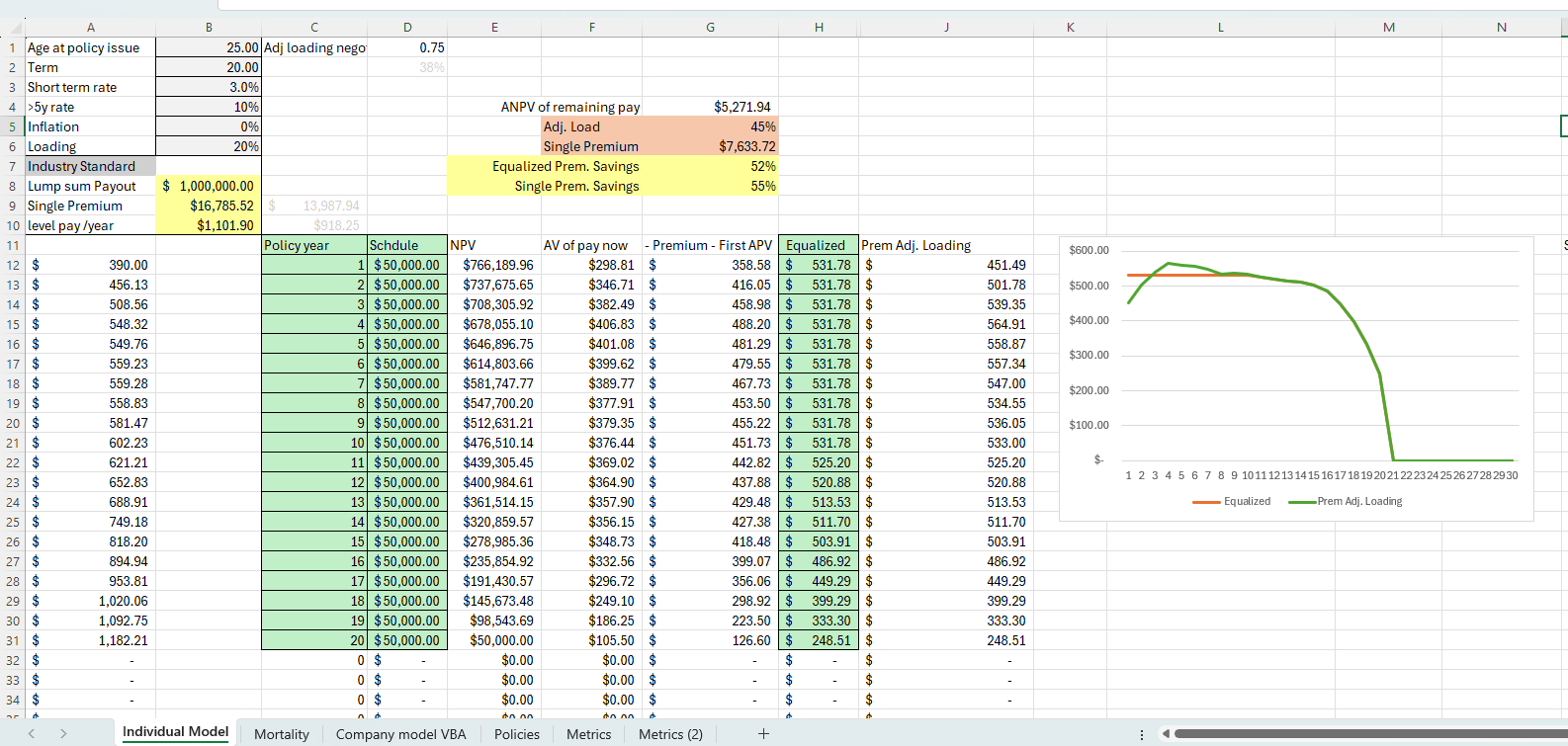

Policyholders can choose either Lump sum or Annual FlexPay. In either case, the same death benefit applies.

One difference is late Annual payments can result in policy lapse. See section “Arrears”.

Annual Premium "moves" because as the policy ages, the death benefit for past years expires

and the cost of Insurance goes down.

Each customer will have their own curve.

The premiums are level before dropping off. see illustration

As the policy ages into year k+1, benefit payable for year k expires. No premiums refundable.

Annual Premiums not yet due can be reduced by reducing death benefit.

Raising death benefit by

adding goals or family members’ needs will

raise future due Premiums non-retroactively and will be subject to Underwriting Review.

Arrears

Annual Premium Policyholders who delay payment 30 days past due, will lapse their coverage.

For coverage to resume NOT retroactively, Policyholders must pay the premium due plus the potential lost

invest income determined by the number of months delayed (rounded up) and the average growth of the surplus pool.

May not allow this option [Those with Monthly payments must pay these installments in the year before the coverage

after paying full annual before the first year. Arrears will be charged in the current year. Lapses will occur in

the following for arrears not paid. Lapses will occur before the month in which APV paid runs out.]